When mortgage interest rates drop, several potential outcomes and effects can be observed in the housing and financial markets. Here are some key impacts:

1. Increased Refinancing Activity:

Lower interest rates often lead to an increase in mortgage refinancing. Homeowners may choose to refinance their existing mortgages to take advantage of the lower rates, which can result in lower monthly payments and potentially significant savings over the life of the loan.

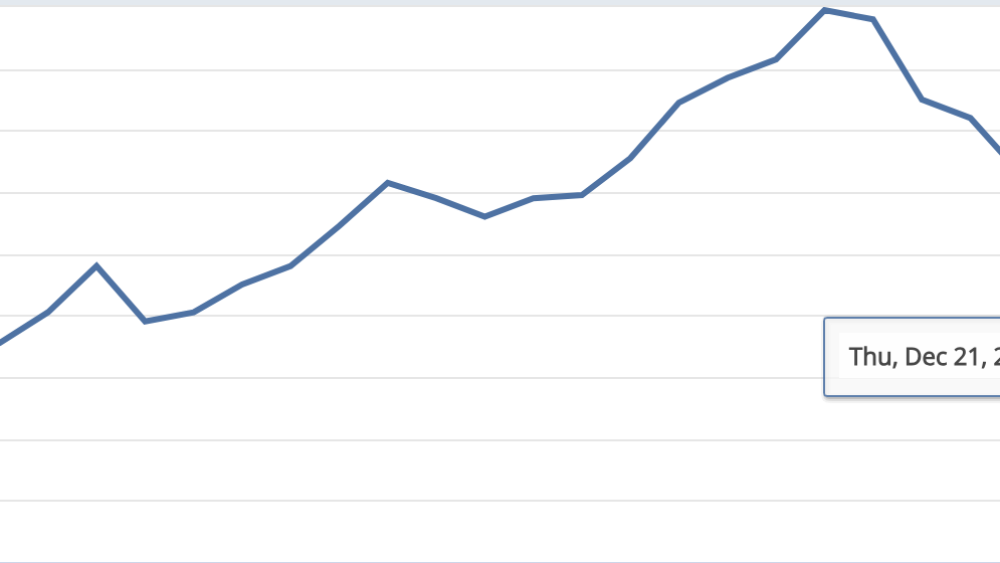

2. Higher Demand for Homes:

Lower mortgage rates can make homeownership more affordable, increasing the demand for homes. Prospective buyers may be more inclined to enter the market, and existing homeowners may find it more appealing to upgrade to larger homes or better locations.

3. Home Prices May Rise:

Higher demand for homes, coupled with a limited housing supply, can lead to an increase in home prices. This is particularly true in competitive real estate markets where demand consistently outpaces supply.

4. Stimulus to the Economy:

Lower mortgage rates can stimulate economic activity by encouraging spending on housing-related goods and services. This includes home renovations, furnishings, and other associated industries.

5. Boost to Construction and Real Estate Industries:

Lower interest rates can spur construction activity and boost the real estate sector. Homebuilders may experience increased demand for new construction projects, leading to job creation and economic growth in related industries.

6. Impact on Housing Affordability:

Lower interest rates generally improve housing affordability. This can make homeownership more accessible to a broader range of individuals and may particularly benefit first-time homebuyers.

7. Impact on Banks and Lenders:

Financial institutions and mortgage lenders may experience a decline in profit margins as interest rates drop. However, increased loan volumes due to higher demand for mortgages and refinancing can offset some of these effects.

8. Potential for Lower Monthly Payments:

For those securing new mortgages or refinancing existing ones, lower interest rates can result in lower monthly mortgage payments, freeing up funds for other discretionary spending or savings.

9. Impact on Investors:

Lower interest rates can influence investment decisions. Investors may look to real estate as an attractive option when interest rates on other investments, such as bonds, are relatively low.

It’s important to note that the specific effects can vary based on various factors, including the overall economic climate, housing market conditions, and government policies. Additionally, while lower interest rates can have positive effects, they may also be influenced by broader economic trends and conditions.